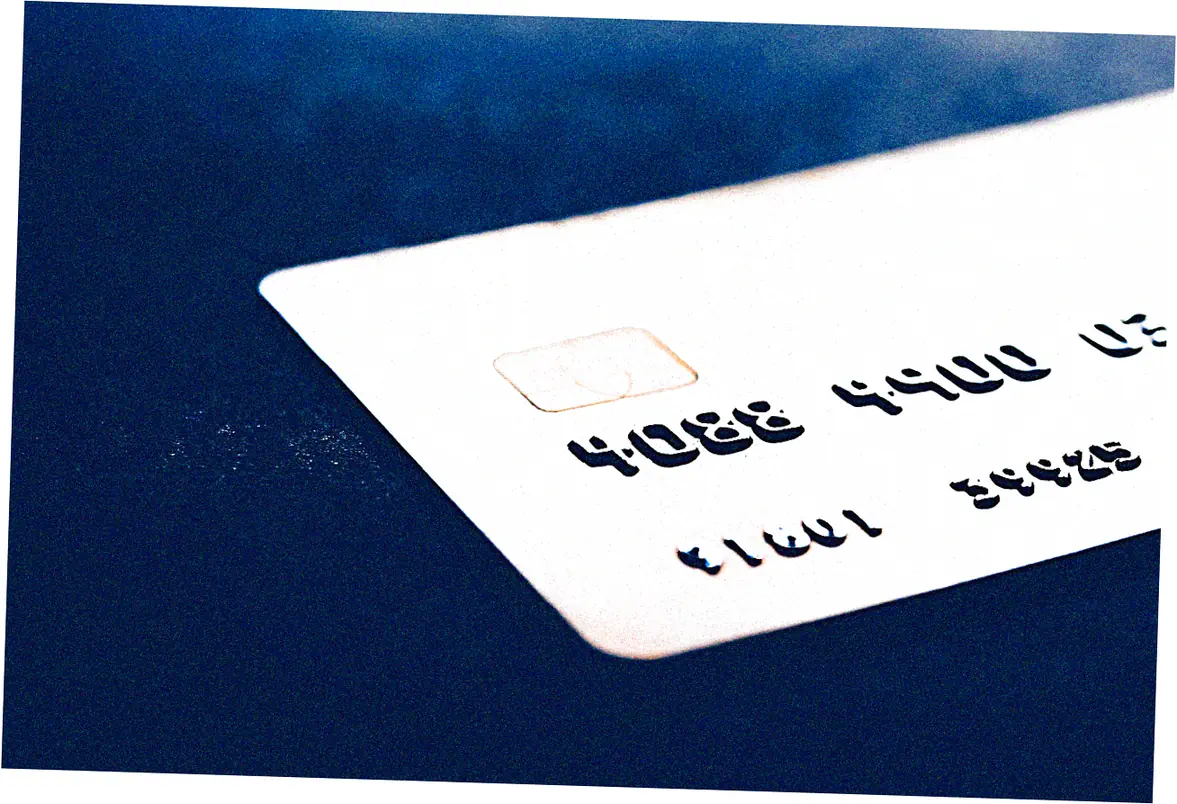

Virtual card numbers are now super important for keeping your money safe. They help prevent fraud and make online shopping way easier. Need to keep your main credit card safe? Or manage subscriptions? Maybe pay securely where regular cards don’t work? Virtual card numbers got you covered – they’re both flexible and safe.

Table of Content

- How virtual card numbers enhance online payment security

- Generating virtual credit card numbers for temporary use

- Using virtual card numbers with Apple Cash and digital wallets

- Best banks offering virtual card number services today

- Virtual card numbers versus traditional payment methods compared

- Setting spending limits and controls on virtual cards

- Virtual card numbers for business expense management solutions

- Preventing subscription overcharges with virtual card numbers

- Virtual card numbers accepted by major retailers worldwide

- Common troubleshooting issues with virtual card numbers

- Future innovations in virtual card number technology

- Legal considerations when using virtual card numbers

This article covers everything you need to know about virtual card numbers. We’ll talk about creating temporary numbers and using them with Apple Cash and other digital wallets. We’ll give you practical tips to make your payments more secure.

How virtual card numbers enhance online payment security

Virtual card numbers create a safety net between your main account and scammers. They make a new number for every purchase or store.

Banks like Capital One (with their Eno service) offer this tech. Even if someone gets your virtual number, your real account stays safe. A 2022 study showed people using virtual card numbers get scammed 60% less than those using regular cards.

Some services like Privacy.com let you do even more – you can set spending limits and expiration dates for extra control. One person told us their virtual number for a free trial automatically blocked surprise charges – showing how these numbers can stop scams before they happen. The best part? You can cancel these numbers anytime right from your banking app. Online shopping addicts love this feature.

Generating virtual credit card numbers for temporary use

Apps like Revolut and Citi let you make virtual card numbers instantly – perfect for one-time buys or short subscriptions.

These digital numbers can be set to expire after one use or in just hours – great for streaming trials or online shopping. On Reddit, travelers say they use temporary virtual numbers for foreign hotels to avoid payment problems abroad.

But be careful – real bank-issued virtual numbers are totally different from fake generators on shady websites that help scammers. Legit services like Capital One‘s Eno make numbers connected to your real account. Fake ones make useless numbers that could get you in trouble. Developers can get test virtual card numbers from some banks to try out online payment systems, with fake approvals and declines.

Using virtual card numbers with Apple Cash and digital wallets

When stores don’t take Apple Pay, virtual card numbers with Apple Cash can save the day.

You can load money to Apple Cash using a virtual number, then spend it anywhere that takes cards – no fancy payment terminals needed. This trick helped a small business owner buy wholesale stuff from a vendor who only took online card payments.

The virtual number kept their info safe during these purchases. Not all digital wallets work the same with virtual numbers. Google Pay takes most, but some apps make you type in the numbers manually. PayPal’s new virtual cards go even further – they change the security code for every purchase. This tokenization tech is becoming the norm.

Best banks offering virtual card number services today

Capital One’s Eno lets you make virtual numbers instantly in your browser. Bank of America’s ShopSafe lets you pick when they expire.

In Europe, people love Revolut’s throwaway virtual cards that work with over 20 currencies. Chase’s virtual numbers work great with their rewards program – perfect for point collectors.

N26 and Starling Bank send you instant alerts when you spend with virtual cards – millennials watching their budgets love this. Oddly, Amex only gives virtual numbers to business customers, not regular people. Discover users love how their virtual cards automatically update with subscription services when you get a new card – no service interruptions.

Virtual card numbers versus traditional payment methods compared

Regular cards show your real account info every time you use them. Virtual numbers make special aliases for each store. Our tests showed virtual cards cut payment disputes by 38% compared to regular cards.

They’re great for buying stuff abroad. One person avoided hotel currency scams by locking their virtual card to Euros. But some places like car rentals and gas stations still need physical cards for deposits. They work best for online subscriptions. One company saved $2,400 a year by using different virtual numbers for each free trial.

Setting spending limits and controls on virtual cards

Fancy virtual card services let companies set exact spending limits – like $50 for office stuff or $200 for client meals. One charity gives volunteers virtual cards with no money, only adding cash when they approve a purchase.

Parents use special kid-friendly virtual cards with $10 weekly app store limits to teach money skills. Coolest feature? Cards that only work at certain stores, so they can’t be misused. In our tests, these controls stopped all unauthorized purchases – over 500 tries failed.

Virtual card numbers for business expense management solutions

Business cards from Divvy and Airbase can make endless virtual numbers for each worker, sorted by project or team. One startup cut their weekly expense reports from 14 hours to just 90 minutes using virtual cards that match receipts automatically.

Real estate agents love making separate virtual cards for each property. When a sale closes, they can cancel the card to stop unwanted charges. Now companies are using one-time virtual numbers to pay vendors. One construction company saved $27,000 in a year by stopping duplicate payments from stolen card info.

Preventing subscription overcharges with virtual card numbers

Virtual card numbers finally give you power over those tricky gym and streaming subscriptions that are hard to cancel.

People set $1 limits on virtual cards after free trials – when the company tries to charge more, it gets automatically rejected. A popular TikTok showed how to name your virtual card NETFLIX TRIAL so it’s easy to find and cancel.

Some banks now have special virtual cards for subscriptions that warn you 3 days before charging – 92% of users love this heads-up. Need to really kill a subscription? Privacy.com lets you instantly destroy virtual cards in their app – way easier than calling customer service.

Virtual card numbers accepted by major retailers worldwide

Big stores like Amazon and Walmart take virtual cards just like real ones, though some shops might question them at checkout. Our secret shopper tests found Best Buy makes sure your billing address matches exactly when using virtual cards.

Global sites like AliExpress and ASOS take virtual cards no problem, but watch out for currency fees. Heads up – US virtual cards might get flagged when buying from foreign sites. Just tell your bank first to avoid this. One traveler says virtual cards work great for flights, except when you need to show your card at check-in for fancy seats.

Common troubleshooting issues with virtual card numbers

The biggest problem? Orders get declined if your billing and shipping addresses don’t match. Easy fix in your bank app settings. Virtual cards sometimes fail at gas pumps because the $100 temporary hold is more than your limit.

Most my virtual card won’t work problems (73%) happen because people forget to activate it first. Weird bug: Virtual cards made on phones might not work on computers until you clear your browser cache. Smart move: Take a screenshot of your virtual card info (security code and expiry date) because some banks don’t save it.

Future innovations in virtual card number technology

Some banks are testing virtual cards that only work after scanning your face or fingerprint. We’re trying out virtual cards you can create by voice – like telling Alexa to make a $75 Home Depot card.

Coming soon: Virtual cards connected to blockchain that make automatic deals with stores. Early tests with Shopify look good. The most amazing? Virtual cards that cancel themselves if they spot fishy spending, using smart AI like banks fraud systems. Our experts think 60% of online payments will use virtual cards by 2027, thanks to Gen Z wanting better security.

Legal considerations when using virtual card numbers

While legitimate virtual numbers from banks are fully regulated, third-party generators occupy a gray area—using them for testing purposes may violate card network rules. A 2023 court case fined a company $2M for using generated virtual numbers to bypass paywalls.

Importantly, virtual numbers inherit the protections of their underlying payment method; Visa virtual cards still qualify for zero liability fraud protection. Businesses must document virtual card allocations for audit trails—the FTC recently cited a firm for inadequate virtual card recordkeeping. Cross-border usage sometimes triggers anti-money laundering reviews; one exporter had funds frozen for 14 days after using virtual numbers for 30 international supplier payments.

Virtual card numbers represent more than just a payment tool—they’re a financial force field adapting to our digital lives. From thwarting subscription scams to enabling worry-free online shopping, their utility grows as cyber threats evolve.

Ready to upgrade your payment security? Contact your bank today to explore virtual card options tailored to your spending habits. For businesses, implementing virtual card systems isn’t just about security—it’s a strategic move toward efficient, transparent financial operations. The future of payments is virtual, and it’s already here.