Ever wonder how much cash your credit card rewards really give you back each year? I used to guess, but then I found out how awesome a dedicated cash back calculator can be. These tools turn confusing points and percentages into real dollar amounts. They show you what your spending is actually worth. Comparing top credit cards? Seeing if that new Revvi card is worth it? A cash back calculator cuts through all the marketing hype. It answers one big question: based on how I spend, which card puts the most cash back in my wallet? Let’s see how you can use this tool to shop smarter and get more rewards.

Table of Content

- Demystifying the Cash Back Calculator: What It Is and Why You Need One

- Choosing the Right Calculator: Online Tools vs. Custom Spreadsheets

- Strategic Spending: Inputting Your Data for Maximum Accuracy

- Advanced Tactics: Stacking Rewards for Exponential Returns

- Real-World Application: Case Studies and Comparisons

- Beyond Calculation: Managing Your Rewards Ecosystem

- Staying Updated: The Future of Rewards and Calculation Tools

- FAQ About cash back calculator

Let’s break down the cash back calculator: what it is and why you gotta have one.

It’s not just about simple math. Here’s how it really works.

A cash back calculator does more than just multiply numbers. It’s like your own personal money-planning tool. You just type in what you spend each month on stuff like groceries, gas, eating out, and travel.

Then, the calculator uses your card’s reward rates for each category. So, say you get 6% back on $600 for groceries, 3% on $250 for gas, and 1% on other things. It gives you the exact total, not just a guess.

This detailed look shows you how much you can really earn from those category bonuses. That’s the secret to getting the most cash back.

Here’s the problem it fixes: it turns confusion into clarity.

Its main job is to cut through all the complicated reward program rules. A card might advertise a flashy 5% cash back, but that could be for rotating categories or you might need to activate it first. A good calculator handles these details.

It asks you which bonuses are actually active. This stops you from expecting a big payout and then getting a much smaller one. It turns all that fine print into a simple forecast of your yearly earnings. You go from guessing to knowing for sure.

Picking the right cash back calculator? You’ve got two main options: online tools or making your own spreadsheets.

First, let’s check out online calculators and what banks offer.

Here’s how to start: use calculators from big financial sites like NerdWallet or Bankrate. They’re great for quickly comparing popular cards. Just pick two cards, enter your spending, and you’ll instantly

see which one gives you more cash back based on your habits. Lots of banks, especially those with good rewards programs, have their own calculators right on their product pages.

But remember, these are made to make their card look good. So use them, but double-check with a neutral third-party tool to get an unbiased view.

Now, let’s talk about building your own personalized tracking system.

If you want total control, make your own custom spreadsheet. Set up columns for spending categories like groceries, gas, and online shopping, and rows for each of your credit cards. Then, enter the reward rate each card gives for each category.

Next, plug in your monthly spending amounts. Use formulas to automatically figure out how much cash back you earn on each card for each category. This DIY method is really powerful because it handles special situations too.

Like when you use specific shopping portals for online purchases, you can stack bonuses on top of your regular rate.

Let’s talk strategic spending. To get the most accurate results from your cash back calculator, you gotta input your data right.

First up, categorizing your monthly expenses.

Here’s the core idea: how accurate your cash back calculator is depends completely on the data you put in. Don’t just guess what you spend—actually track it! For a full month, carefully track every single purchase.

Sort each one into the categories your cash back calculator uses. Most calculators have categories like: groceries, gas, dining out, travel, drugstores, and everything else. This real spending data gives you a solid foundation for your calculations.

You might find out you spend way more on eating out than you realized. That could make a card with a great dining bonus look really attractive.

Now, don’t forget annual fees and welcome bonuses.

This is a key step people often miss: subtract any annual fee from your total rewards. A card might give you $400 back, but if it has a $95 fee, you’re really only netting $305. Always look at the net earnings in your cash back calculator.

Also, remember to include those welcome bonuses. If a card gives you a $200 bonus for spending $500 in the first three months, add that to your first-year total. That can make a card with just okay ongoing rewards the best deal for the first year.

Here are some advanced tactics to stack your rewards and get exponential returns.

First up, let’s talk about using shopping portals to earn extra bonuses.

If you really want to max out your returns, you gotta use your credit card’s shopping portals. Most card issuers have these online malls where you click through to shops like Amazon, Walmart, or Nike.

When you start your shopping there, you get extra cash back on top of what your card already gives you. So when you use your cash back calculator, just add that portal bonus to your card’s base rate.

Say your card gives 2% back online and the portal throws in 5% more—that’s 7% total! That little detail can really boost your earnings.

Next, let’s look at rotating categories and those quarterly activations.

If you’ve got a card with rotating categories each quarter—like the Discover It® or Chase Freedom Flex®—your cash back calculator can’t just be set and forgotten. You have to update it every quarter when the new bonus categories kick in.

I always set a calendar reminder so I remember to tweak my spreadsheet on the first day of the new quarter. Then I plug in my expected spending for the new categories—like PayPal or wholesale clubs—to see if it’s worth switching from my go-to card for those few months.

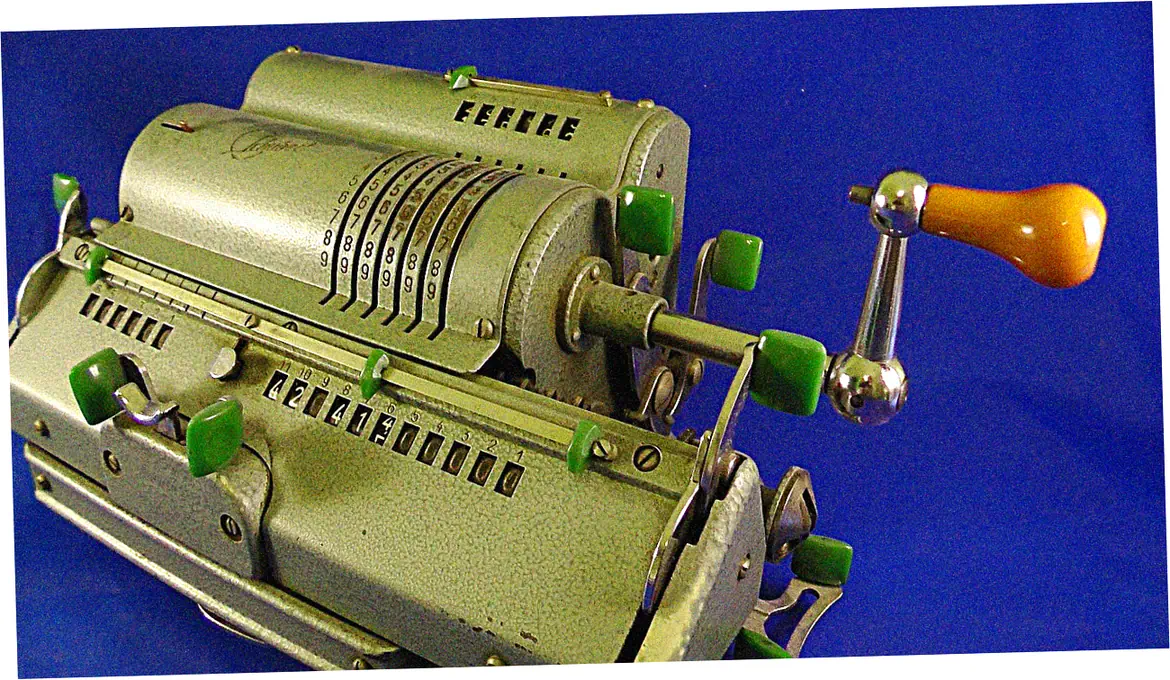

Let’s see how this works in real life with some case studies and comparisons.

First up, a case study on a family’s grocery budget.

Here’s a real scenario to try out. Say a family spends $800 a month on groceries, another $300 on gas, and $500 on eating out. We’ll compare two cards: one gives a flat 2% back on everything, the other has bonus categories—6% back on groceries, 3% on gas, and just 1% on other stuff.

| Spending Category | Monthly Spend | Flat-Rate Card (2%) | Category Card |

|---|---|---|---|

| Groceries | $800 | $16 | $48 (6%) |

| Gas | $300 | $6 | $9 (3%) |

| Dining | $500 | $10 | $5 (1%) |

| Total Monthly Cash Back | $32 | $62 |

The category card earns almost twice as much. That shows how a cash back calculator helps you pick the best card for how you spend.

Now let’s look at a specific card—the Revvi Card.

People often search for the Revvi card, so let’s use a calculator to check it out. It has a unique setup: you get 1% back on all buys, plus another 1% when you pay your bill, so it’s like 2% total. But watch out—it has a high yearly fee.

If you spend $1,000 a month, that’s $12,000 a year, and you’d get about $240 back. But take away the $300 fee for year one (it drops to $150 later), and you actually lose $60 that first year.

I always run this quick calculation before getting any card. It shows the Revvi card might only help if you’re rebuilding credit and can’t get better deals. That’s why reading Revvi card reviews is so important.

It’s not just about calculating – you need to manage your whole rewards ecosystem.

Keep track of your redemption options and their values.

Here’s the core idea: earning cash back is just half the job. The other half? Redeeming it the smart way. Your cash back calculator should guide your redemption strategy. Most cards let you get statement credits or direct deposits.

These usually give you the best value. But some programs try to tempt you with gift cards or merch. These often give you less value for each point. The golden rule? Always check that redemption rate.

Say 10,000 points get you $100 cash, but only an $80 gift card. The choice is pretty clear. A good cash back calculator shows you what your points are really worth.

Get to know the program terms and customer service.

Here’s another core thing: before you depend on a card, understand the provider’s policies. What do you do if you need to dispute a missing reward? How long until your points show up? Do your rewards expire?

Good issuers lay these terms out clearly. They also offer strong customer support for any rewards questions. For example, most big banks let you track your cash back in real-time right on their app.

They have special support lines too. This makes sure you can always see and understand the rewards you worked for.

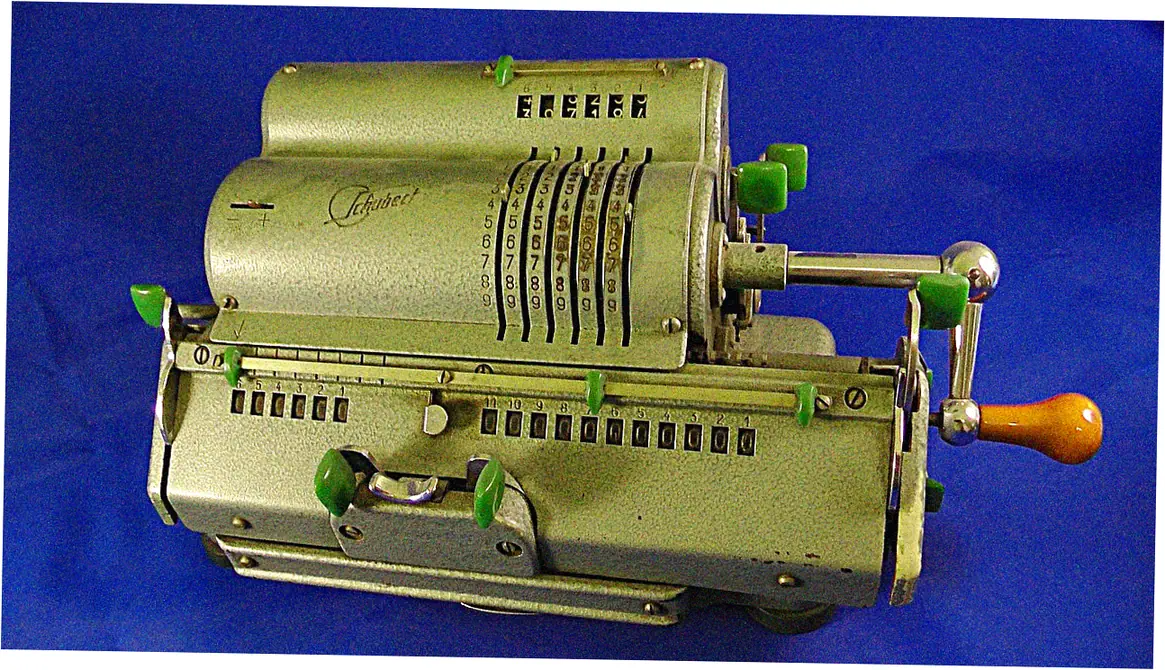

Let’s talk about what’s next for rewards and those handy calculation tools.

New trends are popping up, like crypto rewards and categories that change.

Here’s the deal: rewards are changing fast. Some new cards now give you cryptocurrency instead of plain old cash back. Figuring out what that’s worth gets tricky because crypto prices jump around.

Plus, some apps are testing categories that change based on what you buy. Future cash back calculators will have to handle that. If you keep up with these changes, your strategy and tools won’t get left behind. You’ll keep getting the most back.

Now, let’s look at apps and real-time tracking.

The newest calculators aren’t just websites anymore; they’re built right into phone apps. Picture this: a tool that sees your spending (if you let it) and tells you right at the register which card to swipe for the best rewards.

This smooth, automatic help is the ultimate goal for maximizing rewards. It’s already in some big money apps, so you don’t have to type anything in anymore.

So, a cash back calculator is basically your secret weapon. It makes sense of all those credit card rewards. It turns confusing percentages into real money you’ll actually get, making sure you use the best card every time you spend.

Don’t just hope you’re getting a good deal—know for sure. Seriously, open a new tab right now, find a calculator, and just spend 10 minutes putting in your info.

You might be shocked at how much more cash back you could be getting. It’s the easiest and smartest move to make your money work better for you.

FAQ About cash back calculator

Wondering how often you should check your cash back calculator?

Give it a look whenever your spending changes a lot—like if you switch jobs, move, or have a kid. Or just do it once a year to stay on track. Also, run the numbers again if your card’s terms get updated, or if you’re eyeing a new card—see how it stacks up against what you’ve got.

Do cash back calculators include welcome bonuses?

Yep, the good ones let you plug in that sign-up bonus. That bonus really matters for your first year. A big one can totally make up for an annual fee or so-so rewards—making the card worth it short-term. So don’t forget to include it!

Are cards with high annual fees ever worth it?

Definitely—but only if your cash back calculator says so. Just enter your spending, see what rewards you earn, then take out the fee. If you travel a lot or spend big, those pricey cards can be worth it. You get perks, lounge access, and better rewards—so you end up ahead even after the fee.

Can you use a cash back calculator for travel points and miles?

The idea is similar, even though these calculators are made for cash back. But points and miles are trickier—their value changes depending on how you use them, like flying economy or first class.

For travel rewards, you’re better off using a points calculator. Those use average values for each airline and hotel.