Dental bills can pop up out of nowhere. That’s when folks start looking for payment options like the CareCredit dental card. It’s become the top choice for stuff insurance won’t fully pay for – whether it’s just a cleaning or big braces work.

Table of Content

- How does CareCredit dental financing work?

- What credit score needed for CareCredit approval?

- Are dental credit cards better than personal loans?

- What happens if I miss CareCredit payment?

- Can CareCredit be used for cosmetic dentistry?

- Does CareCredit charge annual or hidden fees?

- How quickly can I get CareCredit approval?

- Can I use CareCredit at any dentist?

- What dental procedures qualify for CareCredit?

- Does CareCredit affect credit score?

- What alternatives exist to CareCredit?

- How to maximize CareCredit benefits?

- What’s the CareCredit customer service experience?

- In conclusion

CareCredit gives you another way to pay medical bills besides regular cards or loans. They’ve got good approval odds and special financing deals. But how does it actually work? And is it right for you? Let’s break down the big questions about dental payment plans.

How does CareCredit dental financing work?

CareCredit works like store credit cards, but it’s just for health costs.

If you’re approved, you get a credit line to use at dentists who take it. The cool part? They offer 0% interest for 6-18 months if you pay it off in time.

Their website says over 250,000 doctors take it nationwide – that’s more than most medical cards.

You can’t use it like a regular card – just at doctors they approve. It covers vet bills, eye care, hearing aids – not just teeth stuff.

First they do a soft credit check to see if you qualify. If you apply, they’ll do a hard pull. You’ll usually know right away if you’re approved. Your limit depends on your credit. Watch out – the CFPB says these medical cards charge way higher interest than regular cards if you don’t pay during the promo.

One plus? You might get a bigger limit than with normal cards, especially with good credit. Dentists push CareCredit because it lets them offer payments without the hassle. But read the fine print! If you don’t pay in full by the deadline, they’ll hit you with all the back interest.

What credit score needed for CareCredit approval?

CareCredit won’t say exactly, but money experts guess you need at least a 620 FICO score. Most people who get approved have scores between 670-850. But they look at other stuff too – your pay, other debts, and how long you’ve had credit.

Fun fact: Their parent bank works with all kinds of credit scores. Even with fair credit (580-669) you might get approved, but with smaller limits and fewer deals.

Under 580? Probably not getting approved unless you make good money or bank with them. That 85% approval rate dentists talk about? That’s their own plans, not CareCredit.

Not sure if you’ll get it? Try their prequalification – it won’t hurt your credit. You can check possible limits and terms without a credit hit. If your credit’s iffy, try applying with someone else or ask your dentist about other payment plans.

Are dental credit cards better than personal loans?

Choosing between dental cards and loans? There’s a few things to think about. Cards are more flexible – use them for other treatments later. Loans give you one lump sum.

But loans usually have lower rates (like 10-12%) versus CareCredit’s 26.99%. For big dental work over $5k, a loan could save you a bundle on interest.

It really depends on how fast you can pay it back. If you can pay in 6-18 months, CareCredit’s 0% deal beats loans.

But if you need more time, that high regular rate is dangerous. NerdWallet says for under $2,500 paid in a year, cards win. For bigger or longer, go with loans.

Also think about your credit score. CareCredit reports to credit agencies, so using it right can boost your score.

Loans report too, but might affect your score differently. Some folks use CareCredit first, then move what’s left to a cheaper loan. Do the math both ways before choosing.

What happens if I miss CareCredit payment?

Skip payments and you’re in for some trouble. First comes a late fee – up to 40 bucks these days.

Worse? Miss one payment during the 0% period and boom – you owe all that back interest. This sneaky interest thing trips up lots of people – it’s the #1 complaint about these cards.

30 days late and they’ll tell the credit agencies – your score could tank 100 points. 60 days? They can cancel your deal and demand full payment.

Really bad? They’ll send it to collections. But if you call them fast about money trouble, they might work with you.

Set up autopay for at least the minimum to stay safe. Some dentists will remind you when payments are due.

If you see money trouble coming, call CareCredit fast to avoid the worst. Treat it like important post-dental care – don’t ignore it.

Can CareCredit be used for cosmetic dentistry?

Yep! CareCredit totally covers cosmetic stuff insurance won’t – veneers, whitening, adult braces. Actually, cosmetic work is one of the top reasons people use dental financing.

It works the same for a needed root canal or just making your smile prettier. Cosmetic dentists push CareCredit hard – it gets them more customers.

But there’s a difference in ethics. Borrowing for needed work feels better than debt for optional stuff.

A study found people regret cosmetic debt more than paying cash. You can still use it for looks – just be really sure you want it and can pay.

Cosmetic work costs more, so the payment terms matter more. A 10k smile fix at 26.99% APR?

That gets crazy pricey if you don’t pay in time. Some dentists have their own payment plans – shop around for big jobs. The cosmetic dentists group says get several opinions and quotes first.

Does CareCredit charge annual or hidden fees?

CareCredit brags about no yearly fees – which beats lots of cards. But it’s not totally free of charges.

Like we said, late payments cost up to $40. Bounce a payment? That’s another $30 fee. Want paper statements? That might cost $2 unless you go paperless.

The real gotcha? That back interest if you don’t read the fine print. Real 0% deals forgive unpaid interest. CareCredit slaps it all on if you don’t pay in time. A $3k dental bill could mean hundreds in surprise interest.

Using it overseas costs extra (not likely for teeth), and rush payments by phone too. Always read the latest cardholder agreement for current fee structures. While CareCredit’s fee schedule is relatively straightforward compared to some credit products, the deferred interest remains the most significant gotcha for unwary consumers.

How quickly can I get CareCredit approval?

Speed is one area where CareCredit shines. The online application takes about 5-10 minutes to complete, and many applicants receive instant approval decisions.

If approved, you’ll immediately know your credit limit and can often use the account the same day by requesting a temporary card number from customer service. Physical cards typically arrive within 7-10 business days, but most dental offices can verify and process payments without the physical card present.

For urgent dental needs, this quick turnaround can be invaluable. Compare this to personal loans which might take several business days to process or dental office payment plans that require credit checks and paperwork. The prequalification process is even faster (about 2 minutes) and gives a reliable indication of your approval odds without affecting your credit score.

That said, not all applications get instant decisions. Some may require additional verification, pushing approval to 1-3 business days.

Applications near credit limit boundaries or with unusual credit histories might take longer. Weekends and holidays can also delay processing. If you’re scheduling elective dental work, applying at least two weeks in advance provides a comfortable buffer for any verification needs.

Can I use CareCredit at any dentist?

CareCredit works at any dental office that accepts it – which includes over 250,000 healthcare providers nationwide but certainly not all dentists. Participation varies by practice, with larger corporate dental chains more likely to accept it than small independent offices.

Before assuming your dentist takes CareCredit, check their website or call the office. The CareCredit website also has a provider search tool to locate participating dentists in your area.

Interestingly, some dentists accept CareCredit but don’t actively advertise it, so it’s always worth asking. The card’s popularity means even non-participating offices may be willing to sign up to accommodate patient requests. For specialists like orthodontists or oral surgeons, acceptance rates tend to be higher than general dentists since their procedures often involve larger out-of-pocket costs.

If your preferred dentist doesn’t take CareCredit, you still have options. Some patients pay with CareCredit at participating providers then get reimbursed by their insurance, effectively using it as a bridge loan.

Others use the card at participating urgent care dental clinics for emergency work while maintaining relationships with their regular (non-participating) dentist for routine care. Just be aware that splitting care between providers can complicate dental records and treatment continuity.

What dental procedures qualify for CareCredit?

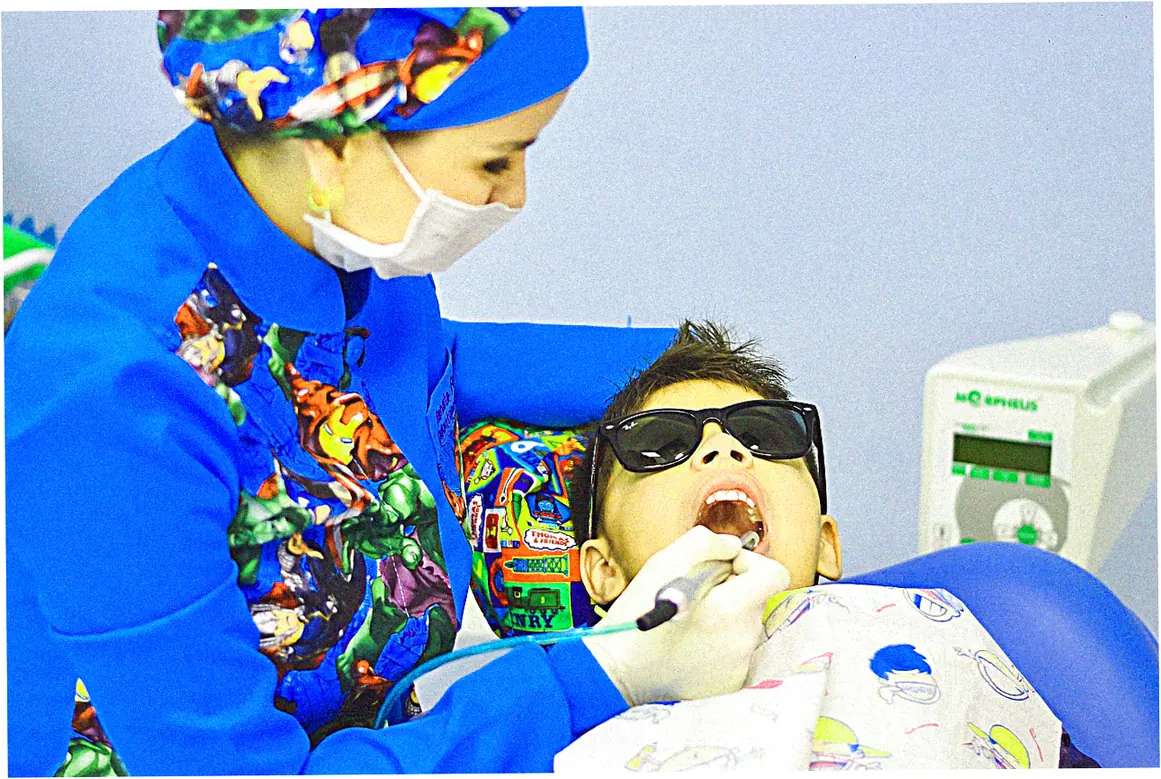

CareCredit covers virtually all dental procedures performed by licensed professionals, from routine cleanings to complex surgeries. Common uses include orthodontics (braces, Invisalign), implants, crowns, bridges, dentures, root canals, gum treatments, and pediatric dentistry. Even non-traditional treatments like TMJ therapy or sleep apnea devices typically qualify if performed or prescribed by a dentist.

The main exceptions are over-the-counter products like toothpaste or floss, and non-dental purchases (you can’t use CareCredit at drugstores for dental-related retail products). Some cosmetic procedures performed by non-dentists like facial fillers may not qualify unless administered in a dental setting. Pre-paying for future services is also prohibited – the card can only be used for current treatment.

Amount-wise, CareCredit handles everything from $200 cleanings to $30,000 full mouth reconstructions, assuming your credit limit allows. Many dentists use it as their primary payment option for cases exceeding insurance maximums.

For very large cases, some providers will split charges across multiple promotional periods (e.g., $5,000 on a 12-month promo now, then another $5,000 on a new promo in six months) to help patients manage payments.

Does CareCredit affect credit score?

Like any credit card, CareCredit impacts your credit score in multiple ways. When you apply, the hard inquiry may temporarily drop your score by 3-5 points.

Upon approval, the new account lowers your average account age (another scoring factor), though this effect diminishes over time. More significantly, your credit utilization ratio – the percentage of available credit you’re using – plays a major role. Maxing out your CareCredit limit could hurt your score, while keeping balances below 30% of the limit helps.

The good news? CareCredit reports to all three major credit bureaus (Experian, Equifax, and TransUnion), so responsible use builds positive payment history. Making on-time payments and paying off promotional balances demonstrates creditworthiness. Some users strategically use CareCredit for small, planned dental expenses just to bolster their credit mix (having different types of credit helps scores).

One unique aspect is that medical debt traditionally hasn’t factored into credit scores as heavily as other debts, though this is changing with newer scoring models. Still, defaulting on CareCredit hurts just like any other credit card delinquency. The takeaway? Used wisely, CareCredit can be a credit-building tool, but recklessness with medical debt carries the same consequences as other credit products.

What alternatives exist to CareCredit?

While CareCredit dominates the dental financing space, several alternatives deserve consideration. Sunbit offers point-of-sale financing specifically for dental offices with reportedly higher approval rates (85% claimed) and no deferred interest.

LendingClub and Prosper provide peer-to-peer personal loans that can be used for dental work, often with lower APRs than credit cards. Some dental chains like Aspen Dental offer in-house membership plans or installment agreements.

Traditional options include health savings accounts (HSAs) or flexible spending accounts (FSAs) if you have one – these use pre-tax dollars and don’t involve credit checks. For major procedures, home equity loans or lines of credit might offer lower rates, though they put your home at risk.

Credit unions frequently offer healthcare loans with favorable terms to members. Even standard 0% APR credit cards (like Chase Freedom Flex) can work for dental expenses if you qualify and can pay within the intro period.

The best alternative depends on your credit, the amount needed, and your repayment timeline. A 2023 comparison by Dental Economics magazine found CareCredit remains the most widely accepted option, but alternatives often beat it on specific factors like approval rates, interest costs, or flexibility. Smart shoppers check multiple options – many dental offices will help patients compare financing solutions during treatment planning consultations.

How to maximize CareCredit benefits?

To get the most value from CareCredit, strategic use is key. First, always confirm the promotional period length for your specific transaction – terms vary by provider and dollar amount.

Schedule procedures early in the promotional period to maximize repayment time. For example, getting treatment in January on a 12-month promo gives you until next January to pay, whereas a December procedure only allows one month before the next calendar year starts the clock.

Next, divide large cases into multiple smaller transactions if possible. Instead of charging $6,000 at once (which might qualify for 12 months promo), consider splitting into two $3,000 charges six months apart to get two 12-month promos.

This requires coordination with your dentist but can dramatically reduce interest risk. Always make payments well before due dates – processing delays could accidentally trigger deferred interest.

Finally, combine CareCredit with other savings strategies. Many dentists offer 5-10% cash discounts that outweigh CareCredit’s benefits for those who can pay upfront.

Using CareCredit for the remaining balance after insurance payments (rather than the full fee) reduces your financed amount. Some savvy patients use CareCredit to capture 0% financing while simultaneously pursuing insurance reimbursements or tax deductions for medical expenses.

What’s the CareCredit customer service experience?

CareCredit’s customer service receives mixed reviews, with satisfaction often depending on issue complexity. For routine matters like balance inquiries or payment processing, the online portal and automated phone system work efficiently.

The website offers comprehensive FAQs and account management tools. However, resolving promotional term disputes or billing errors frequently requires escalation to supervisors.

Wait times vary – during business hours, phone support typically answers within 5-10 minutes, while evenings and weekends may see longer delays. Email responses take 2-3 business days.

Interestingly, many users report better results contacting CareCredit through social media (Twitter/X or Facebook) for urgent issues. The company maintains a BBB rating of A , though it has numerous complaints about customer service communication and deferred interest policies.

Pro tips: Always get promotional terms in writing from your provider before treatment. Save all statements until the promotional period fully closes.

If disputing charges, contact both CareCredit and your dental office simultaneously. For complex cases, consider sending correspondence via certified mail to create a paper trail. While not perfect, CareCredit’s support infrastructure generally suffices for most users needs when approached strategically.

In conclusion

CareCredit and similar dental credit cards fill an important niche in healthcare financing, offering immediate access to treatment with manageable payment plans. While not perfect for every situation – particularly for those who can’t pay off balances during promotional periods – they provide valuable flexibility when facing unexpected dental expenses. By understanding the terms, comparing alternatives, and using strategic repayment approaches, patients can make these tools work to their advantage without falling into debt traps.

If you’re considering CareCredit, start with the prequalification tool to gauge your approval odds and potential credit limit. Discuss all financing options with your dental provider, and don’t hesitate to ask questions about promotional terms and conditions. Remember that dental health is an investment in your overall wellbeing – with the right financing approach, you can address oral health needs without compromising financial health.